April - June 2013

Certification Uncertainty

By Anna Simet - May 06, 2013

The United Kingdom's biomass sustainability criteria may impact U.S. biomass exporters, particularly policy requiring forest certification.

Sustainably sourcing biomass fuel isn't something that's taken lightly in the U.K., and the country is proving it by developing the first nationwide mandatory biomass sustainability standards. As its Renewables Obligation continues to ramp up, the amount of biomass that power utilities will require may significantly increase, and the U.K. is determined to ensure that feed stocks are sourced responsibly.

The RO, a policy mechanism similar to a state renewable portfolio standard in the U.S., requires licensed electricity suppliers in the U.K. to source an increasing amount of electricity from renewable sources. Biomass, particularly imported wood pellets, is an attractive replacement for facilities using coal, and imports from North America are increasing at a rapid rate.

Currently, the country sets general restrictions for biomass materials sourced from land with high biodiversity value or high carbon stock, including primary forest, peatland and wetlands. But this approach has proven untenable over the past two years, according to Suz-Anne Kinney of Forest2Market, as there has been some disagreement over definitions, and because current forest certification schemes alone are not sufficient to meet the criteria.

The U.K. Department of Energy and Climate Change proposed new sustainability criteria last September and a comment period wrapped up at the end of November, but the official standards are yet to be released. As proposed, a biomass power facility would have to demonstrate that 70 percent of the wood used to manufacture the pellets it procures has chain-of-custody (COC) certification, from the forest of origin to the final user. "In order to demonstrate compliance, a supplier must provide independent COC certification of the timber or timber products by one of the major certification schemes," explains Kinney. "In the U.S., especially in the South where the majority of industrial pellet mills is or will be located, widespread certification of this type is not common. As mills purchase wood from dozens of different dealers, brokers or loggers who buy the timber from hundreds of landowners, the scope of any project to increase certification will require significant resources."

So the big question is: will part of the criteria include this requirement of third-party verification of raw

material? While it may sound suitable on the exterior, such a requirement may pose significant challenges to U.S. biomass exporters, and some believe sets unachievable expectations.

Certification and Ownership

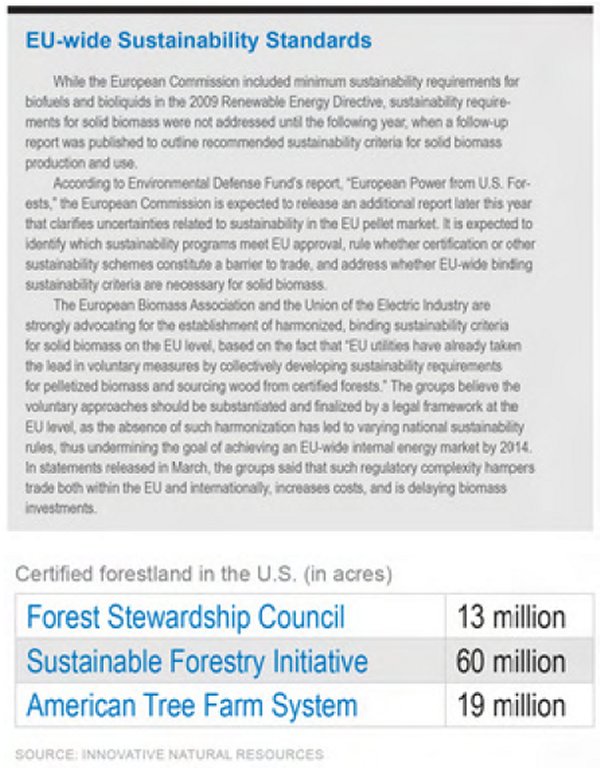

"The problem is that there is a very low percentage of timberland that is actually certified, so it would be very difficult to procure 70 percent of material from certified forests," explains Seth Walker, RISI bioenergy economist. "In the U.S., less than 25 percent is certified, and in the South, it's 22 percent. Actively managed and harvested timber, less than a quarter of it is certified."

According to Robert Simpson, senior vice president of Sustainable Forests & Forest Product Certification at GreenWood Global Consulting, sourcing 70 percent of pellet feedstock from certified sources "will be impossible, unless you have a very large supplying force nearby," he says. "If you're depending on many ma and pop forest owners, it'll be very difficult."

And that's largely the case for biomass sourcing in the Southeast, where about 67 percent of commercial-value forests are privately owned. The forest industry owns another small portion, Simpson says, and the federal government an equal portion. "Interestingly, out of the 134 million acres of procurable and useable forestland in the Southeast, only 3 percent have long-term management plans," says Simpson. Furthermore, only 13 percent have formal management advice.

That's very minimal compared to Europe, according to Simpson, where 77 percent have some type of professional forest management advice. That leads buyers in the European Union to wonder why forest owners in the U.S. aren't certified, when the forests of Europe are regulated and strictly managed. In the U.K, about two-thirds of land is privately owned-very close to the portion that is privately-owned in the U.S.-but both countries differ from the norm, as it is estimated that of the 3.9 billion hectares of the world's forests, 86 percent are publicly owned.

If the U.K. policy comes through as proposed-requiring forest certification-or if an end user demands a high percentage of certified material anyway, it just won't be found, says Simpson. "It's not there, especially for the larger facilities." He recommends smaller family forestland owners contemplating certification to look into group certification, which goes fairly quickly and is less expensive, as it allows multiple forest owners to become certified as a group and share financial costs.

Essentially, the motivation behind the standards stems from the carbon accounting question. "If you cut down trees and don't replant, the carbon story is very different [than if trees are replanted]," says Walker. "There are really two reasons why the U.K. likes certification and sees it as ideal, but at the same time, they know the forests in North America are managed pretty well, and there aren't any major issues with deforestation or bad practices."

That's evidenced by the increasing/stable forest area cover in most U.S. regions. "We have growth exceeding removals, so it's a pretty good story, but it's tough to put that [sustainable] stamp on it," Walker says. One of the main reasons for that is there is a great history of family-owned forests, especially in the Northeast and the Southeast; in the Pacific Northwest there is more federal, state and consolidated land. "So, the Smith family in Virginia has 50 acres of forest and a forester comes in every 10 years and maybe cuts 12 of the 50 acres, in 20 years a thinning, then in 40 years do a clear cut and then replant," explains Walker. "Someone like that isn't going to have any incentive to go through all of the red tape to get that land certified. The biggest indicator of whether land will be certified sustainable, in the U.S., is whether it is owned by a large land owner or financial landowner."

Looking Ahead

If forest certification isn't required, what might be the alternative? "Right now, each of the utilities have to audit their own supply chain, so there might just be some due-diligence requirements, as far as the forest stock around the areas they're procuring fiber from for wood pellets," suggests Walker. There could also be group certification [requirements] where an entire state would become certified to meet necessary standards. "That hasn't happened on a big scale yet, but it has happened on smaller scales," says Walker. For example, FSC worked with a large group of Wisconsin landowners for certification and brought 31,000 new participants into the certification program, more than 2 million acres of privately owned land. "The Nature Conservancy and the SFI (Sustainability Forestry Initiative) are working together to find gaps in the certification program and see if they can fix them," Walker adds, one of which is the small landowner problem.

The National Wildlife Federation is one of those groups working to recruit smaller forest owners to get certified under FSC, and suggests one way to alleviate the cost to smaller landowners is by sharing the cost with the buyer. "We know that in the Southeast and other regions of the country, not all forest owners can afford to get certified, and so we believe that pellet manufacturers and other bioenergy facilities could help cover the cost of assuring regulators and the public at large that their bioenergy sources are truly sustainable," says F.G. Beauregard, NWF Southeast Sustainable Bioenergy manager.

So whether forest certification will ultimately be required is unclear, but in the meantime, what can pellet exporters be doing to prepare for what might potentially be enforced? The first thing is getting chain of custody under these certification schemes, according to Walker. COC verifies company systems for tracking and handling materials used in FSC-certified forest products within the company's operations. Another major preparation measure is securing a supply contract with a large landowner, particularly a financial landowner. "Despite the majority of the actively managed timberland being owned by smaller landowners, there still are very large tracks owned by financial landowners, and those are mostly certified," says Walker. "So, it is possible to get most or all of your timber from a certified source, if you're located in the right place and can set up the right agreement."

So, are the standards likely to remain as proposed? "My hunch is no, because there has been so much invested...it would really almost halt the industry, a strict standard like that," says Walker. "Again, part of the issue is the whole carbon balance, carbon is actually the main issue; they [utilities] have to show a net reduction of carbon over coal. They're concerned about sustainability on one hand, not wanting to promote any sort of bad forestry practices, but they also want that stamp that says whichever forest the wood came from is managed and has a plan to be replanted."

Author: Anna Simet

Managing Editor, Biomass Magazine

701-751-2756

asimet@bbiinternational.com