AgEBB-MU CAFNR Extension

Green Horizons

Spring 2022

Forest Carbon Markets Déjà vu

Hank Stelzer, MU Extension Forestry State Specialist

Do you remember Dogwood Carbon Solutions, Delta Carbon, AgraGate, and CCX? Yesterday's carbon market buzzwords have been replaced by NCX, Forest Carbon Works, and CoreCarbon to name a few. Before you think you are experiencing Déjà vu, stay with me. This arena has evolved since 2008, and it might just stick this time around. To ensure everyone is on the same page in this brave, new world, let's start at the beginning.

Forest carbon markets are 'rooted' in the tree's ability to store carbon. Through photosynthesis, trees convert carbon dioxide (CO2) from the atmosphere into stored carbon. The chemical composition of wood, whether the wood is in the form of a tree or a harvested wood product, is about one-half carbon (measured by dry weight). Carbon accumulates as trees expand in size and volume and as carbon is incorporated into the soils. This growth constitutes the above and below ground biomass - main tree stem, branches, bark, and roots.

An Overview

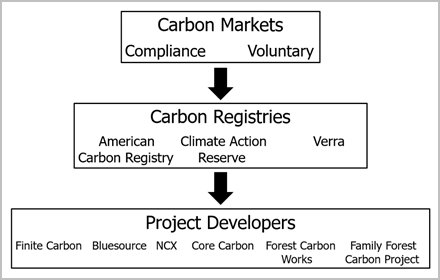

Figure 1 illustrates the structure of the carbon marketplace.

|

| Figure 1. Carbon market structure. |

Beginning at the top of Figure 1, there are the two broad categories of markets: voluntary and compliance. These two markets differ in their defined roles for public and private sector interests.

The middle layer shows carbon registries, which are platforms for listing qualified projects and eligible credits for sale. The major registries list credits for both voluntary and compliance markets.

The third layer consists of project developers. These are the independent organizations and consulting firms that engage with forest owners and land managers to evaluate the feasibility of projects. They also conduct the necessary analysis and verification to confirm that a project is eligible to be listed in a registry (by conforming to the registries' criteria), so the resulting credits can be offered for sale.

MtCO2e and American Forests

A key component of carbon markets is the ability of regulators, buyers, brokers, and sellers to have a commodity that is measurable, quantifiable, verifiable, and trackable. The currency of this carbon commodity is known as a "metric ton of carbon-dioxide equivalent" (MtCO2e). The word "equivalent" in the term is used to standardize all greenhouse gases (GHGs) to CO2. For example, methane is a GHG and has a warming potential 25 times greater than CO2, which implies that 1 ton of methane is equivalent to 25 tons of CO2.

U.S. forests cover an area of 766 million acres and already store and sequester carbon at a significant rate. Across the US, forests, urban trees, and harvested wood products remove 14% of all CO2 emissions and store the equivalent of 33 years of all CO2 emissions produced in the U.S. (Forest Resources Association Fact Sheet).

According to the Dovetail Report, Carbon Storage, Credit Markets, and Forests, less than 8 million acres of today's American forests are in carbon projects. Those same authors claim that the estimated 2030 market will require a ten-fold increase, necessitating 75 million acres to meet demand. That increase will be driven by the voluntary marketplace. If a national carbon policy becomes a reality, the demand would increase by a factor of four.

Credits and Offsets

The terms "credits" and "offsets" are often used interchangeably, although they have slightly different meanings. A "carbon credit" is a transferrable instrument recognized via a carbon market to represent an emission reduction of one metric ton of CO2, or an equivalent amount of other GHGs. The purchaser can 'retire' the credit to claim the underlying reduction towards their own GHG reduction goals. A "carbon offset" is shorthand for GHG emission reductions or removals that compensate for CO2 emissions occurring elsewhere. Additionally, the purchasers of carbon are more likely to refer to them as offsets (as viewed from their perspective), and the producers of carbon storage benefits are more likely to refer to them as credits (reflective of their role in the market).

Forest Carbon Project Types

Currently, three different project types are eligible to produce carbon offsets. For each type, developers must show that their projects are sequestering more carbon than a 'business-as-usual' scenario. Each forest project has different costs, benefits, and approaches of carbon accounting. The first step in the exploratory process is understanding which one is right for your property.

Afforestation/Reforestation (R) Projects restore tree cover to previously non-forested land. These projects have high costs because they generally require significant tree planting and maintenance.

Avoided Conversion (AC) Projects prevent the conversion of forested land to non-forested land. AC project developers must demonstrate that the forested land is under significant threat of conversion for an AC project to be viable.

Improved Forest Management (IFM) Projects increase or, at a minimum, maintain the current level of carbon stocking. They are the most common compliance offsets traded in California's cap-and-trade program.

Key Eligibility Requirements

Every carbon offset project must meet three basic requirements: additionality, permanence, and non-leakage.

Additionality requires the forest project to sequester more carbon than in a 'business as usual' scenario. The project must demonstrate that the carbon sequestration would not have happened without the development of the specific offset project.

Permanence requires that GHG removal enhancements be maintained for up to 100 years. To verify permanence, each project must undergo periodic site visits and audits of inventory reports by an independent third party throughout the life of the project.

Proof of non-leakage requires that project GHG reductions do not result in an unintended increase in GHG emissions in another location. Leakage is the biggest concern involving afforestation projects where cropland is being converted back to forests.

Carbon Marketplaces

Compliance markets exist globally including in the United States. Compliance markets arise when laws or regulations are enacted that limit or cap the quantity of GHG emissions people and firms can emit. Cap-and-trade programs are a good example of compliance carbon markets. The emitters can either reduce GHGs emissions or buy carbon credits from sellers who are sequestering GHGs from the atmosphere. Generally, prices in compliance markets are higher and more stable compared to voluntary markets. The carbon offset price from the California Cap-and-Trade Program on February 10, 2022, was $28.33 per MtCO2e (carboncredits.com).

Voluntary markets exist where companies or individuals buy carbon credits for purely a voluntary reason. Many companies voluntarily purchase carbon credits to demonstrate their commitment to protecting the environment and to demonstrate corporate social responsibility. Carbon offset credits sold on the voluntary market, generally, follow more flexible accounting and measurement guidelines than those sold on compliance markets. A wide range of factors (e.g., type and location of project, additional project benefits, and marketing) can influence the price of carbon credits in voluntary markets. On the same day of February 10, 2022, one MtCO2e traded at $14.95 on the Nature Based Carbon Offset and $7.63 on the Aviation Industry Carbon Offset.

Several factors could drive the future growth of voluntary markets. The rise of new global agreements like the Carbon Offset and Reduction Scheme for International Aviation may increase the demand for carbon credits in voluntary markets. If the number of compliance markets decreases, this could drive demand toward voluntary markets. However, the resulting uncertainty and volatility in voluntary markets could lead project developers to focus on compliance markets for their more stable market conditions.

Carbon Registries

Carbon registries are the platforms for listing qualified projects and selling eligible credits. The major registries list credits for both voluntary and compliance markets. Every registry uses unique forest carbon accounting protocols, which ultimately results in different costs to the project developer. A carbon project viable under one registry may not be viable under a different registry's protocol. It is important to understand the nuances within registry protocols to select which measurement and verification standard is best for your potential project. We will look at the three, common registries current developers are using to access the carbon marketplace.

The American Carbon Registry (ACR) was the first private registry in the voluntary market. It was founded in 1996. ACR protocols have been approved by the California Air Resource Board (ARB) and offset projects registered with ACR can trade their credits on California's cap-and-trade market. ACR has created protocols for all three types of forest carbon projects.

The Climate Action Reserve (CAR) operates in the voluntary market, but its protocols have also been verified by ARB. Projects registered with CAR can trade their offset credits on California's cap-and-trade market. CAR was formed in 2001 by the State of California to serve the voluntary market. Since CAR is tied to California's regulatory body overseeing the cap-and-trade marketplace, it makes it a good candidate for projects developed in North America. CAR also allows all three types of forest carbon projects.

The Verified Carbon Standard (VCS aka Verra) is the most widely used registry in the voluntary market worldwide. VCS registers offsets for IFM, AC, and reforestation projects. Once a carbon project is validated under VCS protocols, the project developers are issued Verified Carbon Units (VCUs), which can then be traded.

Carbon Project Developers

Project developers are the entities forest landowners and managers work through to gain access to the carbon marketplace, be they compliance or voluntary. Historically, carbon projects here in Missouri have been restricted to single ownerships of large tracts of timber whose offsets are traded in the compliance marketplace. The two most notable projects are Finite Carbon's 3,982-acre Shannondale Project and the Bluesource 3,200-acre Alford Forest Project, both located in Missouri Ozarks.

There are two main reasons why it has been difficult for Missouri landowners to participate in carbon projects: (1) compliance markets' desire to deal only with large, single ownerships and (2) until recently, the cost of conducting the baseline inventory and submitting the proposed project to a registry has been prohibitive. This, however, is changing as more buyers of carbon offsets are entering the voluntary markets, and developers are utilizing the latest inventory technologies to drive down their costs.

If one searches the internet for carbon project developers, it is easy to become overwhelmed. To keep things brief and simple for this review, we will examine four developers that are either currently operating in Missouri or plan to operate in Missouri within the next few years. For each developer, we will identify the parent company, the minimum (and, in some cases, the maximum) number of acres, cost to the landowner, length of contract, key contractual requirements, how offset credits are calculated, where the offsets are registered, and active status in Missouri.

Bear in mind this summary information is subject to change as each developer receives feedback and guidance from both the registries and the marketplace. Also, some project developers offer services for multiple registries, and the choice of a registry will influence the project design and the methodologies used to calculate the eligible credits.

Natural Capital Exchange (NCX) NCX grew out of a company originally called SilviaTerra, whose goal was to provide next-generation forest inventory data to customers. There are no minimum acres to enroll, and there is no cost to the landowner. NCX projects are unique in that they are one-year contracts where the landowner is paid to retain forest carbon on their property by deferring timber harvest below a "business-as-usual" harvest level. High-resolution satellite imagery is used to calculate the volume of standing timber by age-class. Artificial intelligence algorithms use past harvest activities and regional timber market conditions to determine the potential harvest risk. The inventory data and the potential risk are then used to assign a specified number of Harvest Deferral Credits to the property to sell on the exchange. A random sample of project properties will be selected for on-site verification. NCX pays for this ground truthing. The landowner can re-enroll their property the following year.

Currently, NCX is the only developer operating in Missouri. Their projects are sold through their own exchange in the voluntary marketplace. They can do this because they have amassed credible buyers (whose identities have been protected by NCX) of their harvest deferral credits. NCX is working with Verra to have their project protocols certified. Once certified, NCX offset credits can be traded in other voluntary markets as well as the compliance marketplace.

CoreCarbon FiniteCarbon created CoreCarbon to develop projects specifically for the small landowner. A landowner must own at least 40 acres, but no more than 5,000 acres. At least 80 percent of the enrolled forest must be eligible for commercial harvest at the time of enrollment. Like NCX, there is no cost to enroll and participate in the program. Offset credits are assessed using remote sensing technologies with random sampling of properties for on-site verification. The standard contract length is 40 years broken into two, 20-year crediting periods. The first crediting period requires landowners to defer from timber harvests in exchange for payments. In the second, 20-year period, landowners can choose to continue their crediting status or move into a non-crediting status. If they choose the latter, they forfeit payments for the remainder of the contract, but they are free to harvest the annual growth from that second period.

CoreCarbon projects are registered on the American Carbon Registry, but the program is currently not active in Missouri. Their goal is to start project development in the Show-Me state in 2023.

Forest Carbon Works (FWC) FCW is an offshoot of EP Carbon and, like CoreCarbon, is designed for small landowners owning at least 40 acres. There is an initial $75 membership application fee that includes the initial forest carbon inventory, verification, marketing, monitoring, and reporting of the project. The contract consists of a 25-year crediting period where one receives annual payments for forest growth. They may renew for up to two additional 25-year crediting periods. However, at the end of their last crediting period, they must enter a monitoring period of 100 years. They must comply with all laws and pay taxes, provide property access to FCW for purposes of the project, and maintain timber rights for the entire period.

The driving force behind these restrictions is so FCW offset credits can be offered in the California compliance marketplace. The California Air Resources Board (aka CAR) serves as the registry for FCW projects. While they are currently exploring potential projects, they have yet to become an active developer in Missouri and do not anticipate becoming one until 2023.

Family Forest Carbon Program (FFCP) FFCP is a partnership between the American Forest Foundation and The Nature Conservancy. A unique aspect of FFCP is that they offer two distinct contract periods depending upon the enrolled practice. Enhancing Future Forests is a 10-year contract where enrolled stands are treated to reduce competing vegetation (by at least 85 percent compared to pre-treatment levels); enrolled stands must maintain that level of control for the contract period; and, if needed, complete any planned regeneration harvests. Growing Mature Forests is a 20-year contract where the landowner develops and follows two, property-wide, 10-year forest management plans. Some sustainable level of harvesting is allowed. For either practice, landowners must own at least 30 acres of forested acres but no more than 2,400 acres. There is no cost to the landowner, and they receive free consultation with a professional forester who prepares a forest management plan and calculates the amount of carbon credits.

Verra is nearing verification of this developer's protocols. Currently, this developer is only operating in Pennsylvania, West Virginia and western Maryland counties. In 2022, they are looking to expand to the Upper Great Lake Region of Michigan and Minnesota. At the time this article was prepared, there was no timeline for Verra becoming active in Missouri.

Closing Comments

The renewed interest in carbon markets is leading developments, such as new protocols for defining eligible credits, expanding the use of technology for measuring and monitoring offsets, and growing the potential for greater financial investment from corporations and private sectors.

Landowners and foresters alike are encouraged to request proposals from multiple project developers to better understand alternatives and compare service offerings. In working with a project developer, one will need to determine which carbon market (voluntary or compliance) they wish to engage in, which influences the project design, as well as the potential value of the resulting credits.