To send a message to an author, click on the author's name at the end of the article.

This Month in Ag Connection | Ag Connection - Other Issues Online

Americans are generous people. Charitable organizations provide valuable goods and services for society. Charitable organizations are largely funded by contributions. There are many more ways to contribute to charitable organizations than cash. Think outside the box the next time you make a charitable contribution.

Donating clothes, furniture, equipment, vehicles, etc. can provide you with a tax deduction and benefit charitable organizations that distribute these items to those in need. While you should have never expected a taxable deduction for worthless items, the IRS Regulations were recently changed to require that donated items must be in "good" condition or better to qualify as a charitable contribution. However, Congress failed to define "good".

Another interesting method of making a contribution is the transfer of appreciated stock you have owned more than one year. As an example, let's say you are in the 25 percent tax bracket and purchased stock in 2002 for $1,000 - that is now worth $3,000. If you sold this stock and gave the net proceeds to a charity - you would give the charity $2,700 ($3,000 less $300 tax). Remember the maximum long term capital gain tax rate is 15%.

As an alternative to selling the stock, you could transfer the stock to the charitable organization and deduct the full fair-market value of the stock without having to pay any tax on the appreciation. This is a win-win for you and the charity. The charity gets more value and you still get your deduction.

Another contribution possibility exists if you have an IRA and are 70 ½ years of age or older. A special provision ends this year which allows you to transfer funds directly from your IRA to a charitable organization. This is one of the few ways that IRA funds can be withdrawn without incurring any income tax liability on the distribution. Additionally, this transfer qualifies for part or all of your required annual minimum distribution.

Cash-basis farmers have another way of contributing to a charitable organization - the transfer of raised production. This involves the transfer of raised inventory from the prior tax year's production. This type of transfer can save income tax as well as self-employment tax.

The key to successfully utilizing any of the above contribution strategies is proper documentation and dotting your i's and crossing your t's. Consulting with your tax advisor or a professional tax return preparer before implementing these strategies is suggested.

(Author: Parman Green, Agricultural Business Specialist)

This Month in Ag Connection | Ag Connection - Other Issues Online

The Ag Experiment Stations at the University of Missouri do a considerable amount of research that can be valuable to Missouri farmers. The following is a list of some of the work that is being done and a link to information on that research.

A study was done with various row spacing with Roundup Ready Soybean to determine the effect of row spacing on spray penetration and yield of soybean. The summary of this study is found at the above site.

Of particular interest in agriforestry might be research being done on forage alley cropping, forage shade study, and bioterracing. Much more research is being done there, these are just a few examples.

Please take some time to browse the Agricultural Experiment Stations across the state. You may be surprised at what is being researched.

(Author: Mary Sobba, Agricultural Business Specialist)

This Month in Ag Connection | Ag Connection - Other Issues Online

A recent survey* suggests that 55 percent of the adult American population do not have a will - one of the most basic tools in estate planning. Common excuses given for failing to have an estate plan are:

It is never too soon to develop an estate plan. Start these discussions with your accountant, banker, insurance agent, lawyer or a trusted friend. While small estates are not subject to federal estate tax - estate planning for other reasons are just as important for the small estate as they are for the large estate. No one in the estate planning arena believes the estate planning regulations will be the same in four years as they are today, but that doesn't mean you should put off developing or adjusting your estate plan. A recommended strategy in this period of legislative uncertainty is to utilize estate planning tools and strategies that provide a high degree of flexibility and reasonableness in cost.

Non-probate transfers such as Pay on Death (POD), Transfer on Death (TOD), and Beneficiary Deeds are examples of tools that meet the above criteria. Even people that have very elaborate trusts frequently utilize these tools for selected assets. For example, personal vehicles are commonly not transferred to a trust and are titled with a TOD to avoid the complications of titling and insuring vehicles as trust assets.

In addition to being relatively inexpensive to create - PODs, TODs, and Beneficiary Deeds provide flexibility by allowing the changing of or cancelling of these instruments. These three forms of non-probate transfers are not considered a gift, thus there are no gift tax consequences. One of the primary benefits of these tools is the avoidance of probate. While the assets will be considered part of your overall estate, they will not be considered part of your probate estate. Additionally, one of the features that many grantors like is that at any time during their life, non-probate transfers may be revoked or the beneficiaries can be changed.

PODs, TODs, and Beneficiary Deeds will not be the best estate planning tools for everyone in every situation. However, they can be very valuable and useful tools to be utilized in a great many estate plans. Visit with your attorney to discuss if these non-probate tools would be appropriate for your estate plan.

*The survey on estate planning was conducted by Harris Interactive® for Martindale-Hubbell®

(Author: Parman R. Green, Agriculture Business Management Specialist)

This Month in Ag Connection | Ag Connection - Other Issues Online

Grain undergoes changes after it is put into a grain bin. You should check the grain and take some steps to ensure that the quality is preserved.

This fall some grain may have an excessive amount of dirt and other impurities in it, especially in those cases where the corn blew over in the wind. Care should be taken that the impurities are removed. They will often accumulate in the top of the bin in the center. This can cause major problems with keeping grain in condition.

After the grain is put in the bin, care should be taken to level it. This ensures even flow of air throughout the grain mass as fans are operated.

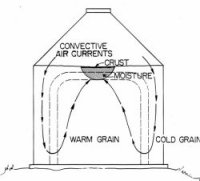

As temperatures lower in the fall, air will move in the grain bin as illustrated in this diagram. The grain along the outside of the bin will cool and air will move downward. Then it will move upward toward the center of the bin. The air may take up some moisture and will warm as it moves through the bin. This can cause condensation to occur at the top center of the bin and cause a crust to form and cause deterioration of the grain. Fans should be run in the fall and the entire bin of grain should be cooled until the temperature reaches 35 to 40 degrees F. This will minimize movement of air through the bin. Fans should be run any time the outside air is 10 to 15 degrees F cooler than the grain in the bin. Once the fans are started, be sure to cool the entire bin of grain. Stopping a cooling front can lead to condensation between the layers, causing grain to deteriorate.

Grain should be checked at least monthly to determine any changes. Temperatures should be taken at several levels and recorded. Fans should be run and the air should be smelled to detect any mustiness. If changes are detected, you may need to run fans to bring grain back into condition.

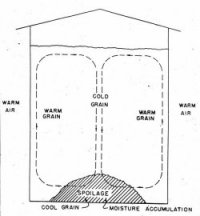

As the outside air warms in the spring, the opposite air movement occurs. This diagram illustrates the direction of air flow in the bin in the spring. The fans should be run to warm the air in the bin to keep air flow from occurring. Fans should be run any time the outside air is 10 - 15 degrees F warmer than the grain in the bin. Warm the grain to about 50 to 60 degrees F. In the spring the spoilage will occur in the lower part of the bin. This is much more difficult to detect. As with cooling grain, warm the entire mass of grain before turning off the fans.

(Author: Don Day, Natural Resource Engineer)

This Month in Ag Connection | Ag Connection - Other Issues Online

Solar water pumps can provide water for livestock in remote areas where it would be expensive to run electrical lines. Increasing electrical rates may make solar pumps more practical even where electricity is available.

Determining the water requirements for the livestock you are watering is the first step in planning a system. After determining the amount of water needed, you will need to determine length of pipe needed and the size needed. The diameter of pipe needed is determined by the length and the amount of water that will be pumped through it.

The volume of water in gallons per minute (gpm) plus the pressure drop through the supply lines, pressure needed at the waterers and the elevation differences between the water supply and the highest waterer will determine the pump size.

Most solar pumps are low volume (2-5 gpm. Most solar pumps operate on 12 or 24 volts and 3 to 4 amps of direct current. One horsepower equals 746 watts at 100 percent efficiency so these are low horsepower. The solar array is sized for the capacity of watts needed. They should be sized for 25 percent more amp capacity than the pump requires.

The following are some good resources on solar water pumping:

(Author: Don Day, Natural Resource Engineer)

This Month in Ag Connection | Ag Connection - Other Issues Online

Publishing Information

Ag Connection is published monthly for Northeast and Central areas of Missouri producers and is supported by the University of Missouri Extension, the Missouri Agricultural Experiment Station, and the MU College of Agriculture, Food and Natural Resources. Managing Editor: Mary Sobba.